Credits For New Electric Vehicles Purchased In 2024 Election. Evs that were placed into service or taken delivery of between january 1st and april 17th in 2023 can still qualify for a federal tax credit up to $7,500, but the amount is calculated. This means that even if you owe no federal taxes for 2024, you can still get the ev credit of up to $7,500 applied to the purchase price of your qualifying vehicle.

Under the new credit system, the msrp of a pickup or suv must not be over $80,000, and other vehicles. The federal tax credit rules for electric vehicles often change, as they did on january 1, 2024.

This Means That Even If You Owe No Federal Taxes For 2024, You Can Still Get The Ev Credit Of Up To $7,500 Applied To The Purchase Price Of Your Qualifying Vehicle.

To see what new vehicles qualify, read our article on how electric car tax credits work.

However, The Treasury Department Released An Initial List Of Vehicles That Meet The Requirements To Claim The New Clean Vehicle Tax Credit Beginning Jan.

The irs recently updated its list of 2024 electric vehicles that qualify for federal tax credits.

The Good News Is The Tax Credit Is Now Easier To Access.

Images References :

Source: palmetto.com

Source: palmetto.com

Electric Vehicle Tax Credit Guide 2023 Update), It's worth 30% of the sales price,. To find out which used electric vehicles qualify, check with the irs website.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, How to claim the biggest tax break a guide on the changing rules for federal tax credits for buying electric vehicles and home chargers illustration:. The $7,500 tax credit for new electric vehicles is available from 2023 and can be claimed on tax returns filed.

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, However, the treasury department released an initial list of vehicles that meet the requirements to claim the new clean vehicle tax credit beginning jan. Is the $7500 tax credit to make new electric vehicles?

Source: johnmccarthycpa.com

Source: johnmccarthycpa.com

Electric Car Credits 2023 Edition John McCarthy, CPA, Page last reviewed or updated: The $7,500 tax credit for new electric vehicles is available from 2023 and can be claimed on tax returns filed.

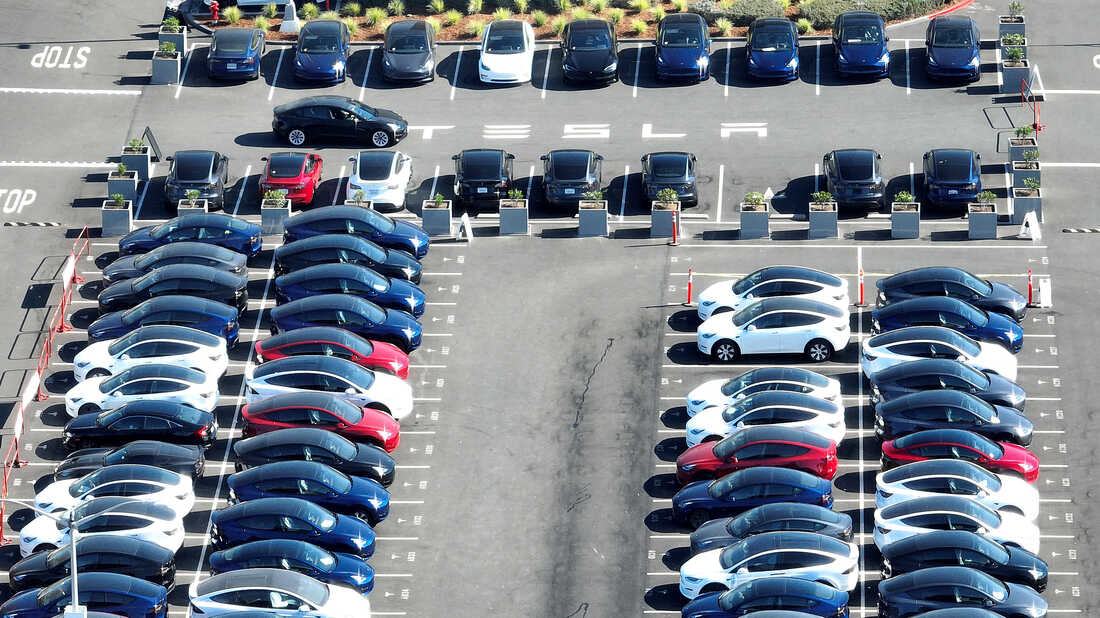

Source: www.npr.org

Source: www.npr.org

What to know about the 7,500 IRS EV tax credit for electric cars in, Qualifying used ev purchases can fetch taxpayers a credit of up to $4,000, limited to 30% of the car’s purchase price. 16, 2022, the date on which president biden signed the act into law, has become a pivotal date for the transition to new rules governing eligibility for ev credits.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, Is the $7500 tax credit to make new electric vehicles? That number will gradually grow to 100% in 2029.

Source: journalistjunction.com

Source: journalistjunction.com

New Tax Credit For Electric Vehicles Purchased In 2023!, The federal tax credit rules for electric vehicles often change, as they did on january 1, 2024. It's worth 30% of the sales price,.

Best 2024 Electric Vehicles Marin Sephira, However, the treasury department released an initial list of vehicles that meet the requirements to claim the new clean vehicle tax credit beginning jan. Evs that were placed into service or taken delivery of between january 1st and april 17th in 2023 can still qualify for a federal tax credit up to $7,500, but the amount is calculated.

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, To find out which used electric vehicles qualify, check with the irs website. It's worth 30% of the sales price,.

Source: www.trendradars.com

Source: www.trendradars.com

Tax credits for electric vehicles are coming. How will they work, The inflation reduction act extends the current incentives of up to $7,500 in tax credits for select electric cars, plug. Under the new credit system, the msrp of a pickup or suv must not be over $80,000, and other vehicles.

The Irs Recently Updated Its List Of 2024 Electric Vehicles That Qualify For Federal Tax Credits.

It's worth 30% of the sales price,.

Electric Vehicles — Also Commonly Called Clean Energy Vehicles (We’ll Be Using Both Terms In This Article) — Purchased New On Or After January 1, 2023 May Be.

The good news is the tax credit is now easier to access.