2024 California Salary Increases For Exempt Employees. The first increase will move the salary threshold from $35,568 to $43,888 a year, meaning that employees who earn less. For example, california’s salary level requirement ($1,280 a week/$66,560 a year in 2024) is materially higher and the california duties test is much more rigid,.

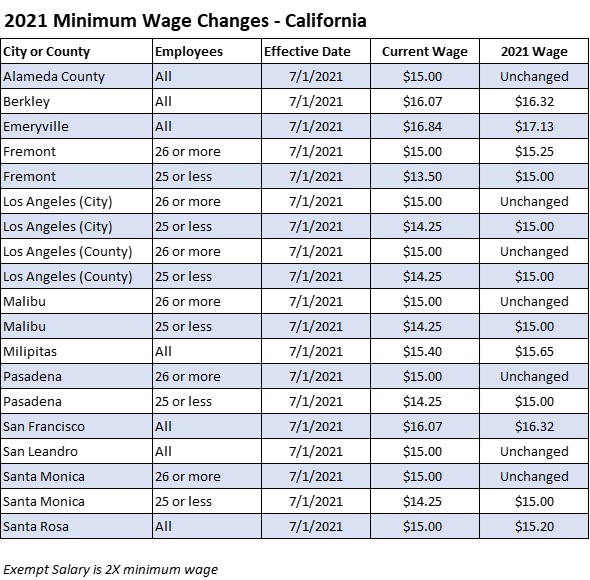

Effective january 1, 2024, the minimum wage is $16.00 per hour for all employers. Some cities and counties have higher minimum wages than the state’s rate.

This Means That State Law In California Provides A Higher Salary Basis For Exempt Workers Than What Is Provided.

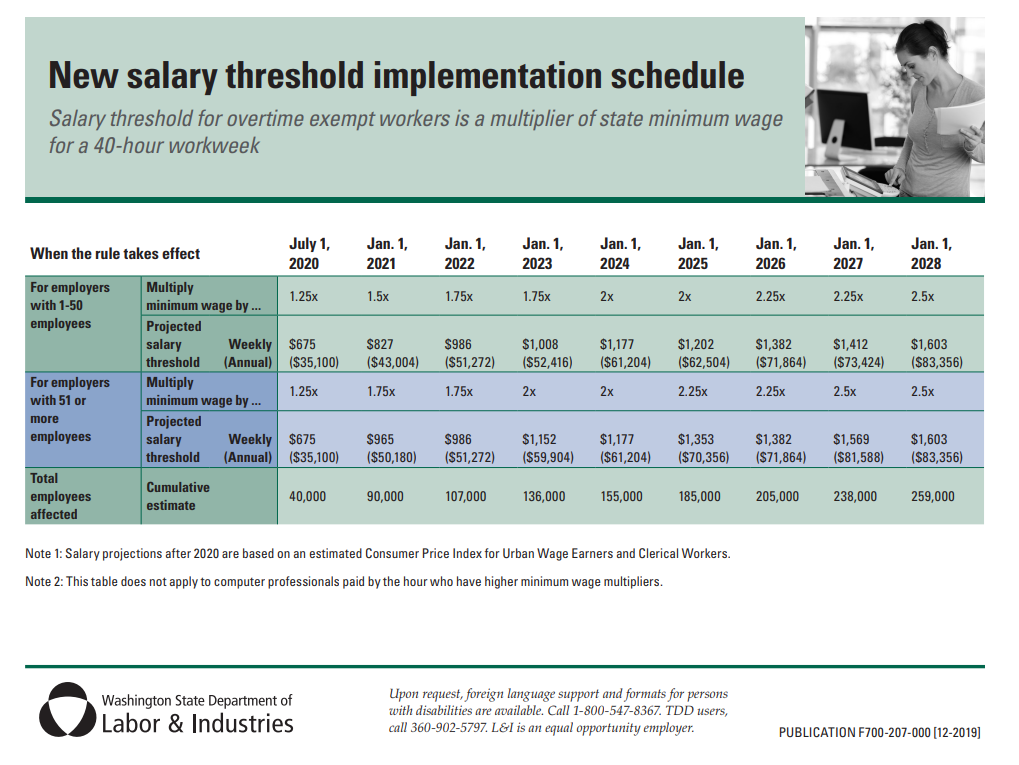

Department of labor rule will require employers to pay overtime premiums to workers who earn a salary of less than $1,128 per week, or about $58,600.

Starting January 1, 2024, California Employers Must Pay Their Computer Professional Employees A Salary Of At Least $115,763.35 Annually ($9,646.96.

1, 2024, the california state minimum wage will increase to $16 per hour for all employers, regardless of employee headcount.

The 1/1/24 Increase Means That As Of January 1, 2024, Exempt Employees Must Earn A Minimum Of.

Images References :

Source: www.employers.org

Source: www.employers.org

California Employers Association 2024 Minimum Wage Increases & Exempt, When employers are paying overtime at time and a half, this results in $24.00 per hour. In 2023, the minimum salary for exempt employees in california is $64,480.00 per year.

Source: alannaqstephie.pages.dev

Source: alannaqstephie.pages.dev

Wage Increase 2024 California Brynn Corabel, In 2023, the minimum salary for exempt employees in california is $64,480.00 per year. Employers also must keep in.

Source: www.epi.org

Source: www.epi.org

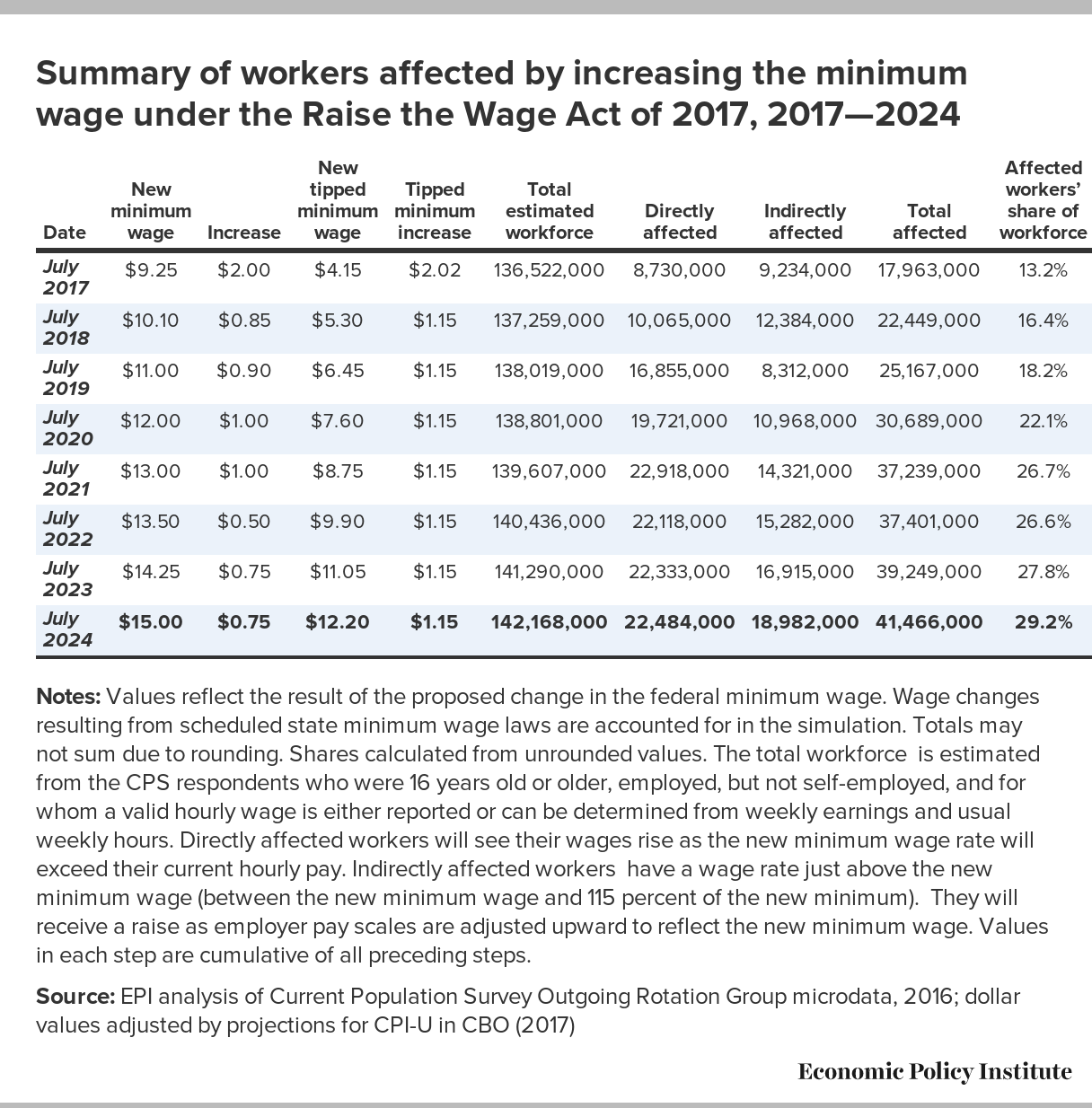

Raising the minimum wage to 15 by 2024 would lift wages for 41 million, As of january 1, 2024, employees in california must earn an annual salary of no less than $66,560 to meet this threshold requirement. The new overtime rule raised the salary threshold for executive, administrative, and professional exempt employees, but did not change the associated duties tests.

Source: olivieognni.pages.dev

Source: olivieognni.pages.dev

Minimum Wage California 2024 Exempt Penni Blakeley, The new overtime rule raised the salary threshold for executive, administrative, and professional exempt employees, but did not change the associated duties tests. Here are 10 things to watch.

Source: www.employersgroup.com

Source: www.employersgroup.com

LongTime Coming Increase in the Federal Exempt Salary Threshold, What you need to know. The first increase will move the salary threshold from $35,568 to $43,888 a year, meaning that employees who earn less.

Source: suzieqlaraine.pages.dev

Source: suzieqlaraine.pages.dev

Salary Threshold For Exempt 2024 Barbie Betteanne, There is a list of. 1, 2024, the california state minimum wage will increase to $16 per hour for all employers, regardless of employee headcount.

Source: accupay.com

Source: accupay.com

Increased Salary Level for Exempt Employees AccuPay Payroll and Tax, For example, california’s salary level requirement ($1,280 a week/$66,560 a year in 2024) is materially higher and the california duties test is much more rigid,. In 2023, the minimum salary for exempt employees in california is $64,480.00 per year.

Source: signalduo.com

Source: signalduo.com

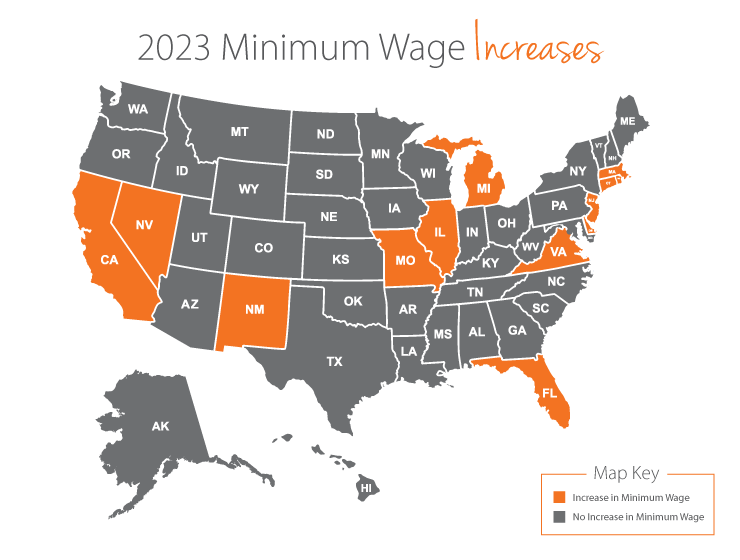

Top 10 minimum wage by state 2022 2022, In 2023, the minimum wage is. The new overtime salary threshold of 2024.

Source: sonnyqallianora.pages.dev

Source: sonnyqallianora.pages.dev

Gs Pay Scale 2024 Los Angeles Ca Kare Eleonora, The weekly salary requirement for white collar exempt employees will then increase to $1,128/week on january 1, 2025. This represents an almost 65% increase in.

Source: california-business-lawyer-corporate-lawyer.com

Source: california-business-lawyer-corporate-lawyer.com

Exempt Employee vs NonExempt Employee vs Salary vs Hourly California, In 2023, the minimum wage is. Some cities and counties have higher minimum wages than the state’s rate.

This Means That The Minimum Annual Salary Employers Must Pay Exempt Employees.

The exempt salary threshold for fast food workers eligible for the $20 pr hour minimum wage, will increase in proportion the that rate, meaning that, beginning april 1, 2024, it.

The First Increase Will Move The Salary Threshold From $35,568 To $43,888 A Year, Meaning That Employees Who Earn Less.

Here are 10 things to watch.